20+ paycheck calculator hawaii

Federal Payroll Tax Compliance - 2017. Back to Payroll Calculator Menu 2016 Hiwaii Paycheck Calculator - Hiwaii Payroll Calculators - Use as often as you need its free.

Rajnath Singh Looking To Scale Up Engagement Defence Minister Rajnath Singh Visits Hawaii Command The Economic Times

Use ADPs Hawaii Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

. SunBiz Calculators Free Payroll Calculators. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Supports hourly salary income and multiple pay frequencies.

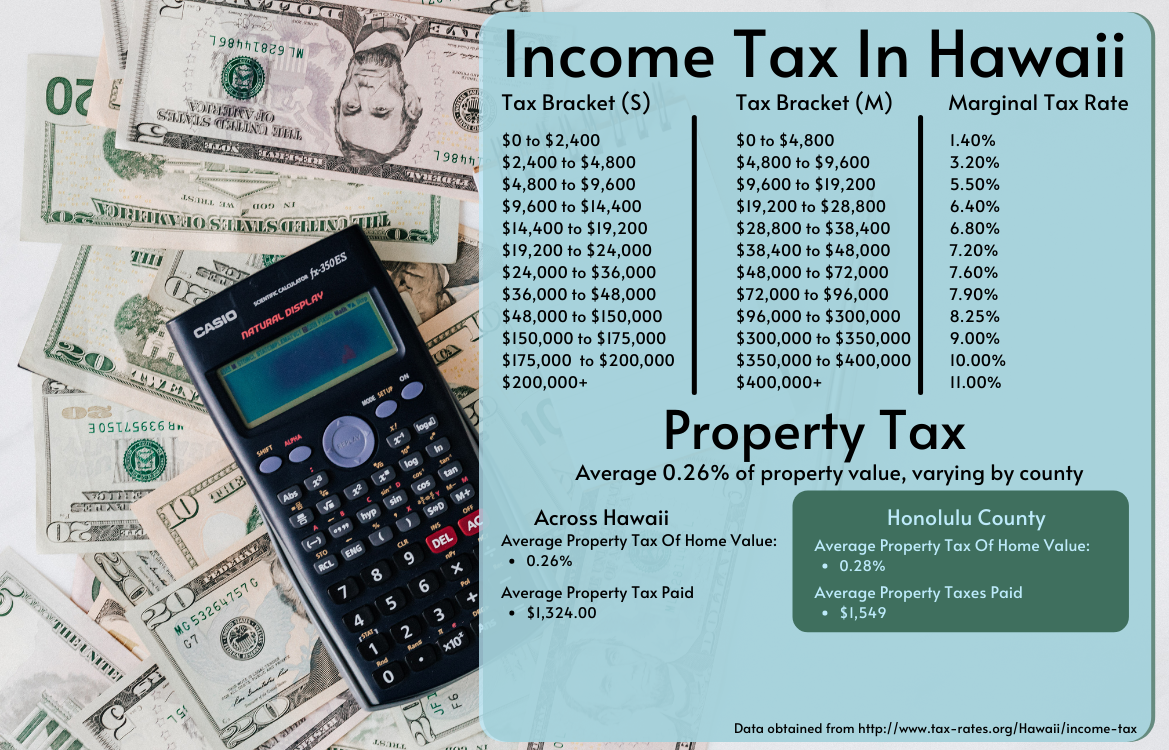

The state income tax rate in Hawaii is progressive and ranges from 14 to 11 while federal income tax rates range from 10 to 37 depending on your income. This free easy to use payroll calculator will calculate your take home pay. Your employees estimated paycheck will be 70372.

For example if an employee makes 25 per hour and. Just enter the wages tax withholdings and other information required. The Hawaii Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Hawaii State Income.

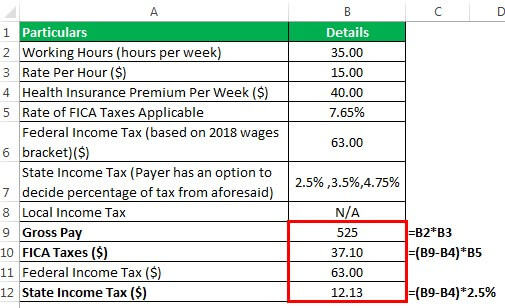

Calculate your Hawaii net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and. Hawaii Salary Paycheck Calculator. The regular hours of work during this pay period will also be 50.

Hawaii State Unemployment Insurance SUI As an employer in Hawaii you have to pay unemployment insurance to the state. Hawaii Hourly Paycheck Calculator. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your. Lets go through your gross salary in further depth. Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider.

Need help calculating paychecks. Hawaii Hourly Paycheck and Payroll Calculator. Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider.

Calculating paychecks and need some help. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Hawaii. Then multiply that number by the total number of weeks in a year 52.

This hourly paycheck calculator are for those who are paid on an hourly basis. Multiply the hourly wage by the number of hours worked per week. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

The 2022 tax rates range from 02 to 58 on. Payroll pay salary pay check payroll tax.

Moon Jellyfish Aurelia Aurita In The Baltic Sea A Violet Coloured Download Scientific Diagram

How Does The Social Security Administration Decide How Much Ssi To Pay Me

Cost Of Living In Hawaii 2022 Your Handy Guide

![]()

Less Than Container Load Lcl Approved Freight Forwarders

Tip Tax Calculator Primepay

Genetics Dna Tote Bag Reversible Tote Biology Gifts Etsy Hong Kong

Average Optometrist Salary Calculator Eyes On Eyecare

Aunty S Beach House Kids Club At Aulani Brings All The Fun Touringplans Com Blog

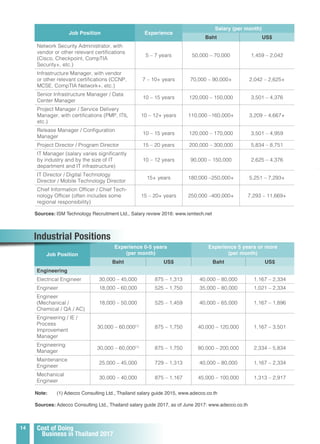

Costs Of Doing Business In Thailand 2018

The State Of Hawaii Case Study Google Cloud

Def 14a

Hawaii Paycheck Calculator Tax Year 2022

Medreps Salary Calculator Medical Sales Careers

Army Pre Retirement Briefing Hq Army Retirement Services Dape Rso 200 Stovall St Alexandria Va March Ppt Download

Take Home Pay Definition Example How To Calculate

How To Make 400k And 500k In Your First Year As A Hospitalist

Hawaii Salary Calculator 2022 Icalculator